In Europe there is VAT - in the US sales tax

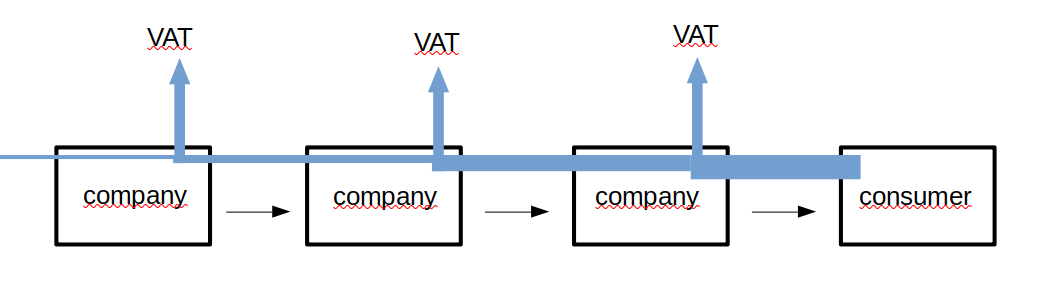

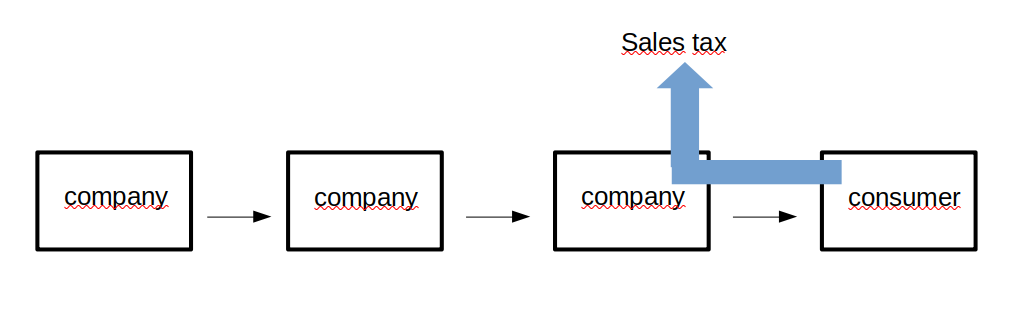

In Europe, companies belonging to the production chain account for the VAT paid by the consumer to the state in proportion to their value added. The US sales tax, on the other hand, is billed entirely by the company that made the consumer sale. Sales tax is paid to local operators, not to the state.

The value added tax (VAT) originating in Europe is different from the sales tax used in the USA. However, both are taxes where the consumer is the payer, i.e. they are consumption taxes. The use of value added tax has spread very widely around the world, the most significant exception being the USA and its sales tax.In the VAT system, the VAT paid by the consumer is paid to the state by the companies involved in the production chain. Each company pays or pays tax to the state on its own value added.

If the company has bought products and services for the manufacture of its products for, say, €100 and sells the products on for €300, the value added is €200 and thus the payable value added tax is calculated on this €200.In US sales tax, on the other hand, the company that sold the product to the consumer accounts for the tax in full to the entities that collect it.

US sales tax is a local tax. Sales tax is therefore not collected by the federal government, but by local actors such as states, counties, cities and municipalities and other local actors, each of which also has different tax rates.

VAT does not fit in to the US system

The introduction of a value added tax system in the United States would require that the federal government starts taking responsibility for collecting the tax, and this is hardly politically possible there. VAT cannot be introduced directly to current local operators due to the fact that the companies in the production chain are located in different places: cities, municipalities, states, where different tax rates are also used. As a curiosity, it should be mentioned that Maryland even has its own percentage calculation!

The resale certificate exempts you from sales tax

When a company buys products or services from another company in the United States in order to resell them, it must give the other company a resale certificate and thus the other company is exempt from paying sales tax.

In the United States, sales tax is not in use in all states. Such states include Alaska, Delaware, Montana, New Hampshire and Oregon.

The differences describe political struggles

Looking at the pictures at the beginning of this article, value added tax looks like a more complicated system than sales tax. However, the strong local levels of the United States with different tax rates for products and services, multiple taxes and resale certificates make the system more complex. European VAT is not simple either. In European states there are different tax rates, different tax rates apply to different products, and some products and operators are excluded from VAT.

The political struggle over the distribution of wealth can be seen both between the European and American systems as well as within them.

Author:

Sources and additional information:

What is the difference between sales tax and VAT?

What is Use Tax?

Published: 13.12.2022

Latest articles with the same tags:

Roundings in VAT calculation: Mathematically impossible prices?

There are a whole range of VAT-inclusive prices that cannot be mathematically arrived at if the tax is calculated from the VAT-free price. One example is 3.99. These prices are also possible, but then the VAT-free price must be interpreted as rounded.

History of taxation

Many of today's taxes were already in use in Antiquity. Deciding on taxation has moved from autocrats to parliaments and the level of taxation has risen. In earlier times taxes were used to wage wars, today taxes are used to maintain welfare states.